AI, Power, and the Future — Books by David L. Wadley

Stories where artificial intelligence, power, culture, and Black futures collide

AI Stocks Made Simple

Finance | Beginner’s Guide

to AI Investing and

Online Trading

Kamala 2028

Afrofuturist Political Thriller | AI, Elections,

and Black Power

The AI Revolution

Will Not Be Televised

Fiction | Artificial Intelligence,

Economics, and Black Empowerment

Passport Bro

Contemporary Fiction | Global Identity, Masculinity, and Power

Bulls, Bears, and Bad Bitches

Finance & Culture |

Markets, Money, and Power in Modern America

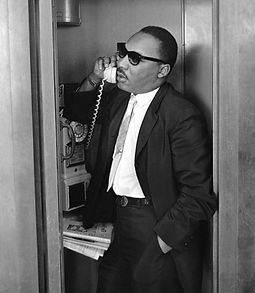

Jesse Jackson and David L. Wadley

🏆 Literary Titan Gold Book Award Winner

🏅 Readers’ Favorite International Book Award Finalist

Meet the Author: David L. Wadley

David L. Wadley is an award-winning author and SEC-accredited investor whose books explore artificial intelligence, power, economics, and Afrofuturist futures. His work blends political thrillers, cultural insight, and accessible nonfiction to examine how technology reshapes democracy, wealth, and opportunity.

What These Books Explore

-

Afrofuturism and Black futures

-

Artificial intelligence and algorithmic power

-

Political thrillers and election suspense

-

Technology, economics, and culture

-

Community resistance and collective strategy

Why These Stories Matter Now

David L. Wadley’s work connects modern AI systems to historical struggles for economic justice, drawing inspiration from movements such as the Black Panthers, the Poor People’s Campaign, and the evolving Fourth Industrial Revolution.

The recognition of The AI Revolution Will Not Be Televised on April 4, 2025—coinciding with the anniversary of Dr. Martin Luther King Jr.’s assassination—underscores the continuing relevance of economic self-determination in the age of AI.

Start Reading Today

Explore the books, discover new futures, and step into stories where technology does not erase humanity—it challenges it.

Leslie Picker

CNBC Senior Finance & Banking Reporter